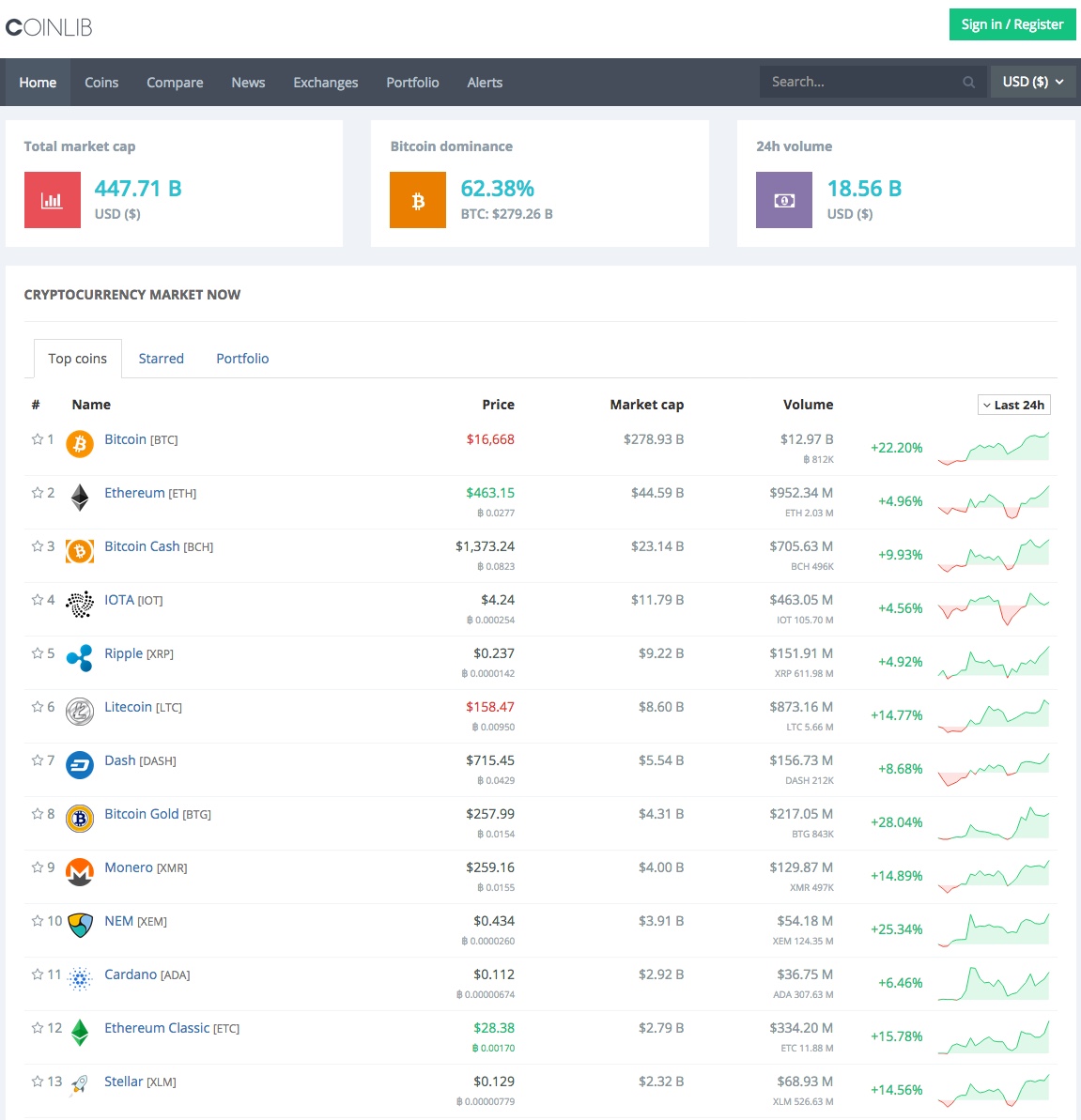

Many cryptocurrency traders like to compare different digital assets by market cap, but a clearer picture of reality can be gained by looking at other metrics.

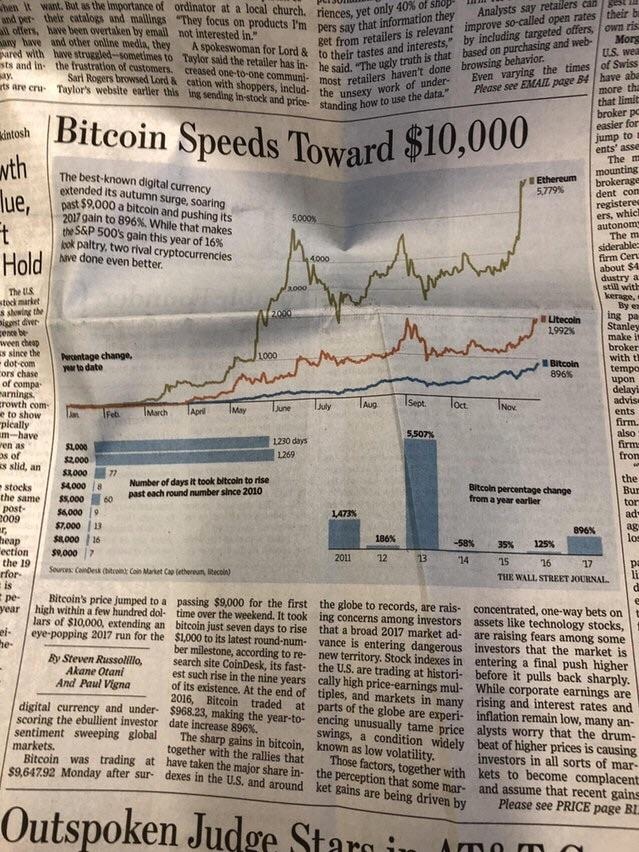

Although bitcoin was launched as the only cryptocurrency in the world back in 2009, there are now thousands of alternatives that can be traded on various online exchanges. Many cryptocurrency traders track the price of these digital assets on sites like CoinMarketCap.com, but the key metric that is most often used to compare these cryptocurrencies, market cap, can sometimes be misleading.

Having said that, there are a few alternative metrics that can be used to compare the different digital assets found in the world today.

What’s Wrong with Market Cap?

While market cap is usually a useful metric for tracking the total valuation of a company, the same is not true in the world of cryptocurrencies. This is because there are often situations where the units included in the calculation for a coin’s market cap — simply the number of coins multiplied by the current price in US dollars — are not easily available for trade.

Steem was another notorious example of an inflated cryptocurrency market cap. The market cap was reported as more than $400 million in July 2016, but this was due to a large amount of Steem being locked up as Steem Power, which is used as a sort of fuel to vote on the social media platform built around the token. Much of the new Steem coming into existence was locked up as Steem Power by default, and only a fraction of that new Steem was actually going into circulation.

In addition to these sorts of situations where new supply cannot actually be traded on an exchange, there are also numerous situations where one entity holds a large amount of the coins in existence from the start. If this entity (or a cartel of entities) keep their holdings off exchanges, they can create a situation where there is a meaninglessly high market cap for a coin with not much activity around it.

In addition to these sorts of situations where new supply cannot actually be traded on an exchange, there are also numerous situations where one entity holds a large amount of the coins in existence from the start. If this entity (or a cartel of entities) keep their holdings off exchanges, they can create a situation where there is a meaninglessly high market cap for a coin with not much activity around it.A study from blockchain analytics company Chainalysis concluded that nearly 4 million bitcoins are likely lost forever, which means the world’s most popular cryptocurrency’s market cap may also be quite misleading.

For example, if Forbes created 1 trillion ForbesCoins out of thin air and then sold one ForbesCoin to someone for $1, that would mean the market cap for ForbesCoin would be $1 trillion. But obviously, that valuation would be worthless information because the market would crash if all of the other ForbesCoins were put on the market.

Long story short: There is a lot of funny business that can go on with cryptocurrency market cap calculations. This is not to say that the market cap metric should be thrown out entirely, just that it needs to be combined with other data points.

Tracking Metcalfe’s Law

Earlier this year, FundStrat co-founder Tom Lee told Business Insider that 94% of bitcoin’s price movements over the past four years can be explained by tracking the number of users on the network. The FundStrat method for tracking user growth combines the number of unique addresses and the USD-denominated transaction volume per address.

This is a model based on Metcalfe’s law, which states that the value of a network is proportional to the square of the number of the users on the network.

It’s unclear if FundStrat adds a requirement for there to be some bitcoin in the counted addresses, but that would make sense to avoid a bit of noise. It costs no money to create a new address, but there is a transaction fee associated with transferring bitcoin to that new address.

It should be noted that this data point may be easily gamed on networks with low transaction fees, even if addresses with no balances are thrown out.

Another possible issue with this method is that new addresses are not necessarily created when users are buying bitcoin and other cryptocurrencies on exchanges (the exchanges hold the funds in their own addresses); however, user growth statistics are sometimes shared by exchanges in the space.

Another metric people have used to value these networks in the past is the number of transactions happening on the network per day. While the bitcoin price effectively grew along with the number of transactions per day in its early days, that trend was broken this year as the price exploded with the number of on-chain transactions per day remaining rather stagnant.

FundStrat’s use of USD-denominated transaction volume rather than the bulk number of transactions is likely a move in the right direction.

More Metrics to Watch

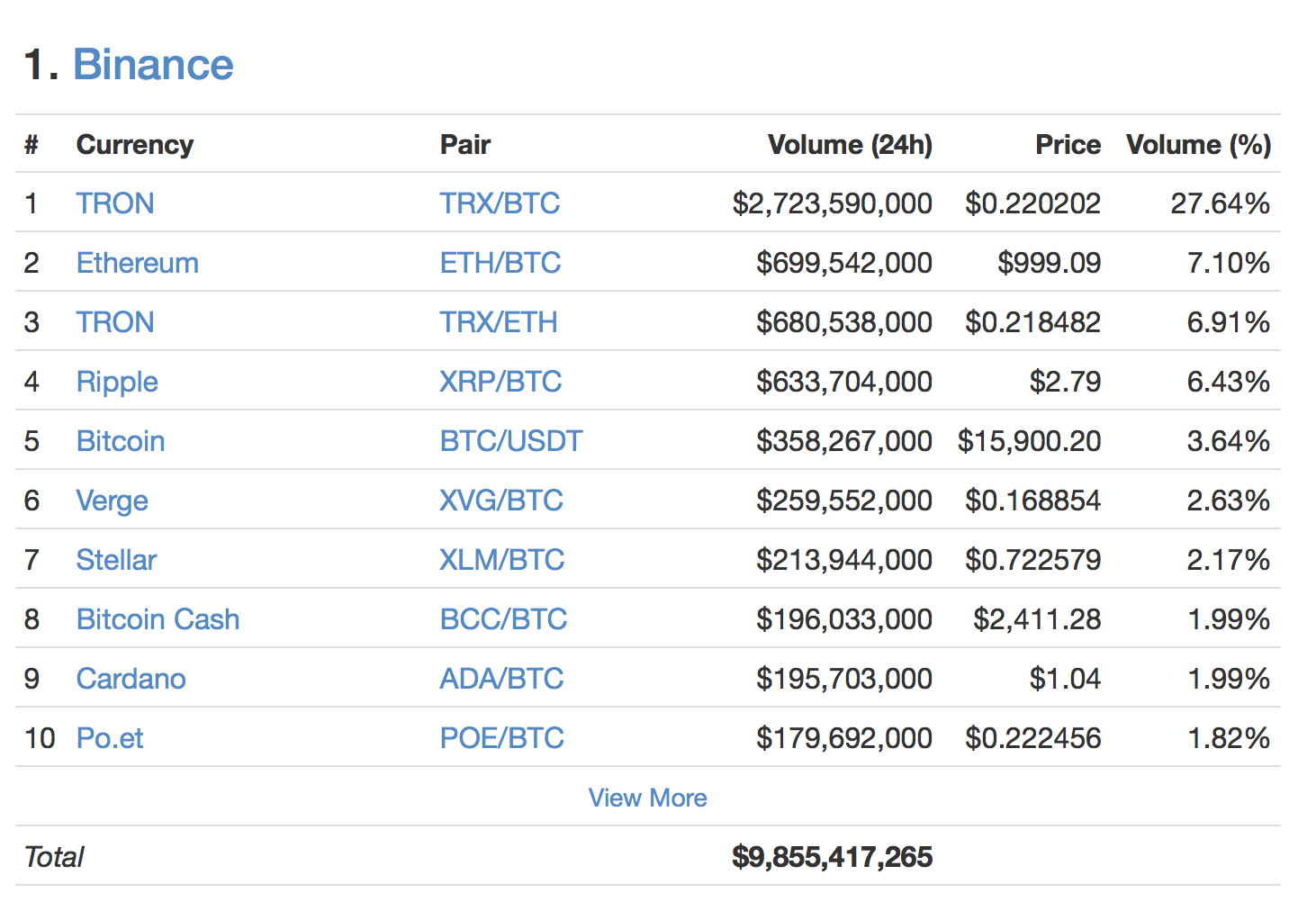

In terms of other data points to watch, it’s best to stick to metrics that are not easily gamed. For now, this could mean some combination of trading volume on exchanges (ignoring exchanges with no fees), the total USD-denominated transaction volume, and the median transaction fee paid to miners.

The easiest way to see there’s something fishy going on with a particular coin’s market cap is by looking at the trading volume on exchanges. A lack of liquidity on exchanges means a whale could come in with a large amount of coin and crash the market at a moment’s notice.

It’s also best to look at monthly volumes rather than daily volumes to avoid spikes caused by the hysteria around a boom or bust in a particular coin on a single day.

With USD-denominated transaction volume, one can see how much activity is actually taking place on the cryptocurrency network’s base layer. By combining this data point with the median transaction fee paid to miners, cryptocurrency networks would be unable to pat their stats by sending meaningless transactions back and forth with large sums of money.

The amount of money collected by miners for transaction fees is another interesting metric to track. This may be the most illuminating data point to watch in terms of learning about the usefulness or desirability of a specific cryptocurrency network. This is effectively the total amount of money that people are willing to pay to use the network on a daily basis.

One thing to keep in mind here is that some of these alternative mechanisms for measuring the value of cryptocurrency networks become worthless on systems with strong privacy guarantees. For example, it is impossible to know how much money is being sent around the Monero and Zcash networks.

I first used Bitcoin in 2011 and have covered the topic as a writer since early 2014. Subscribe to my daily newsletter, YouTube show, and podcast. Follow me on Twitter (@kyletorpey).

Source: forbes.com – Comparing Bitcoin and Other Cryptocurrencies by ‚Market Cap‘ Can Be Very Misleading

As can be seen above, blocks are still full because thousands of transactions are waiting to move, but the queue has been dropping from 25,000 to 20,000.

As can be seen above, blocks are still full because thousands of transactions are waiting to move, but the queue has been dropping from 25,000 to 20,000.