Cryptoasset Valuations – Chris Burniske – Medium

Cryptoasset Valuations

Recently, an increasing number of crypto market participants and observers have become interested in a framework for valuing cryptoassets. Over the years many a dinosaur has proclaimed bitcoin valueless, an asset worse than tulips (at least with tulips you got a flower). Now they’re trying to figure out how valuable these assets really are. That’s a big win for the magic internet money community.

In this piece I share some early attempts at crypto valuations to give perspective on how early we still are, then discuss the theory I’m currently using and why, before walking through a fictional bandwidth coin valuation that includes a link to the actual model. Each section operates as a standalone, so feel free to skip amongst them.

Early Days of Cryptoasset Valuation

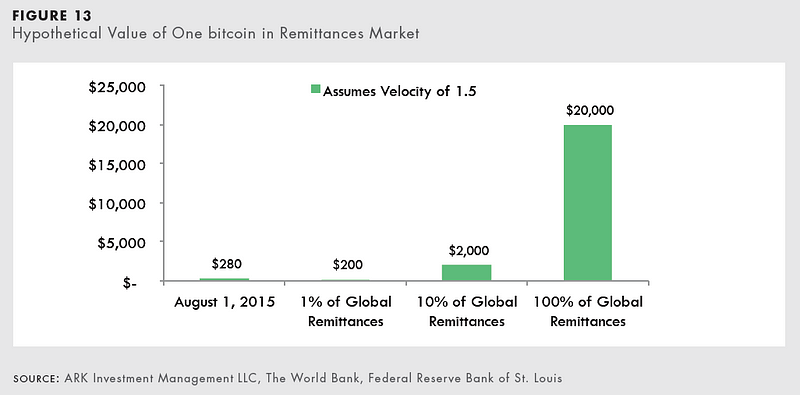

The first time I attempted to value bitcoin was at ARK Invest, where I started as a buy-side analyst in 2014. ARK became the first public fund manager to invest in bitcoin in September of 2015, and to do so we had to have some basis to justify current prices ($200’s), or at least quantify the potential for significant asset appreciation. Other asset managers will have to do the same as part of their fiduciary duty, which is one reason everyone’s become so interested in cryptoasset valuations. Below is an example valuation from a paper I wrote with Dr. Arthur B. Laffer to complement ARK’s 2015 investment, which serves as a nice starting point.

While an overly simplified assessment of value, this graph gets across a few key concepts, mainly total addressable market (TAM), percent penetration of that market, velocity, and number of coins outstanding…

Hinterlasse einen Kommentar

An der Diskussion beteiligen?Hinterlasse uns deinen Kommentar!