On May 6, 2010, the stock market collapsed. The Dow Jones Industrial Average, Nasdaq Composite and S&P 500 all nose-dived, losing around 9% of their value. A trillion dollars was wiped off the value of companies. Within 20 minutes, most of the losses had been regained and within 36 minutes and the event was over. Whatever hit the economy that day had nothing to do with the true state of America’s finances.

An investigation into the Flash Crash focused on the algorithms used by high-frequency traders, companies that rapidly buy and sell stocks as their computer programs spot small price differences across the market. Five years later, police arrested Navinder Singh Sarao, a small trader who was believed to have made more than $40 million during the crash. Trading from his small house in London, he was alleged to have used a computer program to rapidly place sell orders to drive down prices, cancel the orders before the trades went through, then buy the stocks at the lower rate. He wasn’t the only one to make money that day, but his actions were enough to help move the market.

Metaphorical cheers and laud claps were heard across eth spaces as cats were once again seen roaming freely on the blockchain following a raising of the gas limit by ethereum miners.

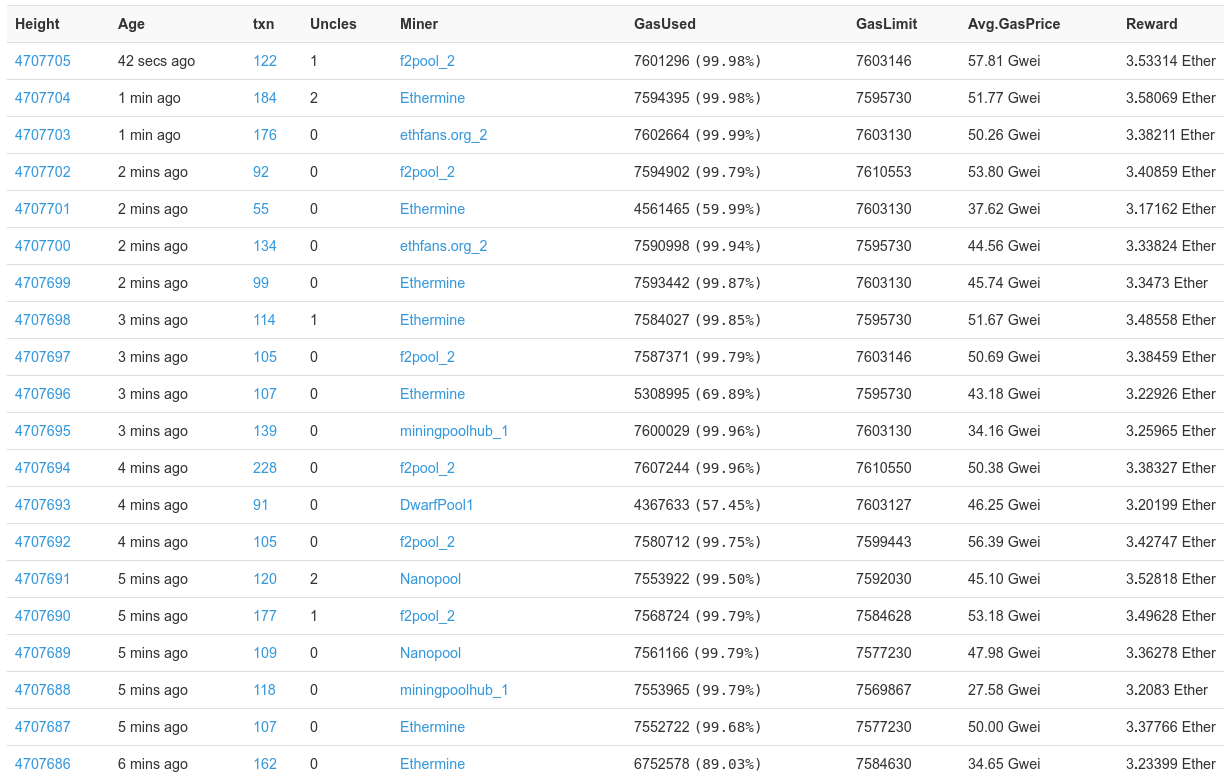

Ethereum’s capacity has now risen to 7.6 million computations per block, up from around 6.7 million, and seems to continue rising at the time of writing.

As can be seen above, blocks are still full because thousands of transactions are waiting to move, but the queue has been dropping from 25,000 to 20,000.

As can be seen above, blocks are still full because thousands of transactions are waiting to move, but the queue has been dropping from 25,000 to 20,000.

Fees are also coming down. They were at 57 cent yesterday, now they stand at 28 cent and might drop further in the coming hours/days.

It is unclear at this stage whether miners have raised the gas limit following some simple protocol improvements, or whether they have opted to give the network some breathing room while we wait for these improvements

Read the full article: http://www.trustnodes.com/2017/12/10/ethereum-miners-save-kitties-capacity-raised

Sizing up Bitcoin is a tall order. Even as the price of one bitcoin soared above $10,000, a debate raged over what, exactly, Bitcoin is: A digital store of value, a revolutionary payment platform, or the promise of a completely new, blockchain-based financial system.

The truth is that Bitcoin is all of those things, but whether it’ll succeed as all three — or any of them — remains to be seen.

The most important problem these upgrades were supposed to fix bitcoin’s biggest problem—that it’s escalating popularity had exposed an underlying issue with Bitcoin’s distributed database. The issue limited just how much Bitcoin could process at any one time, making the network congested and transactions expensive (not to mention power-hungry).

Put simply, while Bitcoin has exploded in value and popularity, the base technology has remained stagnant. And that casts a shadow on its future — right when competition among cryptocurrencies is on fire.

Auch das aktuelle Papier, eine Langzeitbetrachtung über die „reale Konvergenz in der Euro-Zone“, war der EZB eine solche Hintergrundrunde wert. Immerhin geht es um eine der besonders heiklen Fragen der Währungsunion.

Quelle: Infografik Die Welt