R3 Uses Blockchain To Streamline KYC For Banks Around The World

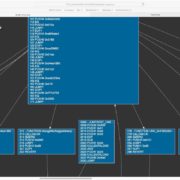

R3 is a financial innovation enterprise that aims to design and deliver distributed ledger technologies to global markets. They lead a consortium partnership of over 50 of the world’s top financial institutions. Through collaboration with their partner research centers, they’re working to test blockchain technologies and their applications towards developing a global financial-grade ledger.

Along with ten of its member banks, R3 has recently developed a proof-of-concept for a Know Your Customer (KYC) registry. KYC is about doing customer due diligence, and determining a valid identity. The systems currently in place are meant to catch identity theft, avoid fraud, prevent money laundering, and stop terrorist financing.

Over the course of three months, R3’s Lab and Research Center utilized blockchain technology to create a KYC registry that would satisfy regulatory requirements, as well as allow identities to be managed by their owners. According to a statement from R3, the project was able to simulate the establishing of the identity of both an individual, and a legal entity, including identity attestation by a third party. The transparency, and immutability of storing identification information in the blockchain seems like a logical choice for fighting illicit activities in the financial sector.

KYC is an important aspect of modern banking which would benefit from an overhaul. Long turnaround times and needlessly redundant processes have made for an inefficient current model. As costs rise, and the process continually grows in complexity, banks are beginning to struggle with their customer on-boarding process. A study by Reuters showed some financial institutions were spending upwards of $500-million annually in relation to KYC compliance. CEO of R3, David Rutter, said:

„The growing complexity and cost of KYC compliance requirements presents a major challenge for banks on-boarding new clients and is having a negative impact on those client relationships. Distributed ledger technology can provide a unified view of clients whilst also significantly reducing costs and time spent verifying identity.“

If R3’s platform were to be deployed, participants would be able to create their own identities, and link them to any relevant documentation. What’s great is an individual would manage their own identity, and simply permission access to their ID when necessary. In this system, a company could request additional validation through authoritative participants to attest to an ID. This means only those who need access to your data will be able to see it, because you specifically enabled that access.

This idea is similar to how distributed ledgers would revolutionize the healthcare industry, particularly in regard to the storage of medical history on a blockchain. With the implementation of R3’s KYC registry it would enable a customer to have one global ID, completely in their control. This increases security for the individual, and increases cost-efficiency for financial institutions.

Quelle: R3 Uses Blockchain To Streamline KYC For Banks Around The World

Hinterlasse einen Kommentar

An der Diskussion beteiligen?Hinterlasse uns deinen Kommentar!