An Intro to TrueBit: A Scalable, Decentralized Computational Court.

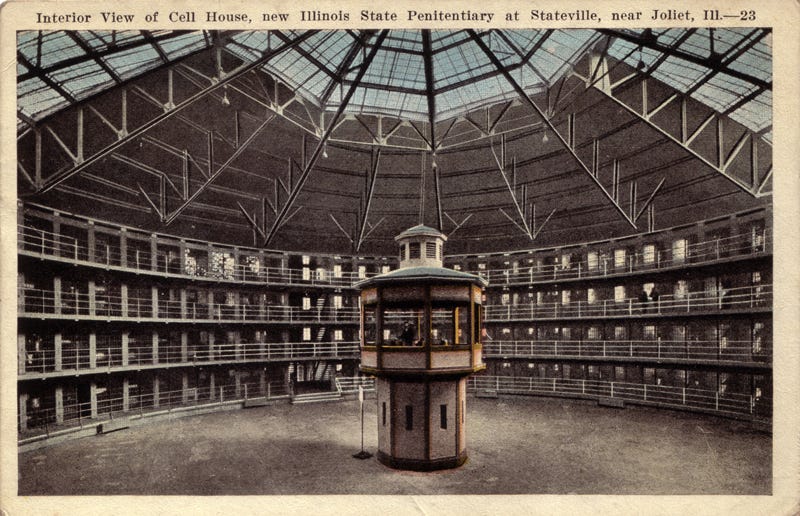

or: “An Intro to Panopticomputers: Code Execution Courts for Scalable, Decentralized Computation”.

The Ethereum community never ceases to amaze me. So many smart people working at the fringes of what’s possible. We haven’t really scratched the surface of what’s possible in the current iteration and we are already seeing amazing new opportunities come to the fore.

For the unenlightened, Ethereum can be described as a distributed “world computer” using blockchain technology. It allows developers the ability to upload code to a blockchain, upon which it executes the code when activated to change some information on a shared ledger. In other words, you can apply arbitrarily complex state changes to a shared, public (relatively) immutable ledger. Every node in the p2p network runs these state changes, whilst specific computers (the miners) make sure these state changes are difficult to reverse (by being rewarded the subsidy & fees). In order to execute state changes & computations one pays proportionally with the cryptocurrency of the platform, ether. The more computations you want to do, the more you will pay for it. The amount of computations are measured in a separate unit, called “gas”.

Source: An Intro to TrueBit: A Scalable, Decentralized Computational Court.