Build an Open Investment Bank Using OpenLaw

Today OpenLaw is releasing its second vertical OpenLaw Finance. With OpenLaw Finance creating legally compliant tokenized securities, fixed income products, tokenized real estate, and smart derivatives can be as easy as filling out a simple form. The future of decentralized finance is coming into focus powered by OpenLaw.

Ethereum holds out the potential to serve as the commercial operating system for the globe. Launched only five years ago, Ethereum is rapidly emerging as the spine for a streamlined financial system where existing financial products can be structured and administered more efficiently. Despite the downturn in prices, Ethereum’s growth has accelerated over the past two years. We’ve seen the birth of stable coins, like DAI, and the threads of more advanced financial products like those provided by Dharma and Compound. Ethereum-based trading platforms are beginning to mature, like 0x and Uniswap, creating composable financial legal blocks that enable assets to flow more seamlessly between parties. And decentralized oracles like Chainlink are moving to mainnet, holding out the hope of inputting real-time data into commercial relationships and creating new, more efficient means of commercial transactions.

Traditional finance, of course, has noticed. An increasing number of banks and other “fintech” startups are exploring the use of blockchain technology through the issuance of their own stablecoins and a host of pilot programs ranging from J.P. Morgan’s stablecoin to SWIFT’s instant GPI payments.

The blockchain-world and traditional finance are on a collision course with new tools and approaches rapidly painting a picture of what a more democratized and streamlined financial system could look like — one that is more efficient, transparent, and resilient.

Blockchains Made Legal

OpenLaw is the missing piece between the crypto world and traditional finance, providing easy to use tools to build legally compliant blockchain-based deals and structures. Today, lawyers architect financial transactions, and OpenLaw enables them to port those transactions to the world’s financial operating system — Ethereum. Using OpenLaw’s robust set of open source tools, anyone can manage the entire process of building blockchain-based financial transaction. You can create tokenized assets, tie them to legally binding agreements, pull data related to the transaction, and manage the lifecycle of the agreement. Just how legally compliant exchanges, like Coinbase and Gemini, helped catapult blockchain from the fringes of the Internet to presidential tweets. OpenLaw increases the range of possible blockchain-based applications by enabling tokens to represent real-world rights and obligations in a way that complies with existing financial systems. It’s blockchain made legal.

Introducing OpenLaw Finance

With our release of OpenLaw Finance, we’re taking one step further towards the future of finance. OpenLaw has spent the past year modeling a range of financial products for the blockchain era, including: syndicated loans for the Loan Syndication Trading Association (LSTA), complex credit facilities, tokenized real estate, smart derivatives, tokenized carbon credits, and even M&A escrow relationships.

We’re bringing these early efforts together into one comprehensive offering, enabling anyone using OpenLaw Finance to create and issue security tokens, fixed income products (like bonds and other debt instruments), create smart derivatives, and tokenize commodities like carbon credits. OpenLaw Finance is plugged into 0x’s blockchain-based decentralized exchange to quickly list tokens and has also deployed some basic AML/KYC related tools to ensure that only whitelisted addresses (or addresses not appearing on a blacklist) engage in financial transactions.

Our new vertical is a leap beyond what exists in the market today — with existing blockchain-based financial platforms primarily focused on a narrow swath of the financial services industry (like real estate or security tokens), even though the act of creating and sending a token is about as exciting as sending an email in mid-1990s.

Our initial offerings have some sample transactions, but OpenLaw Finance is infinitely extendable. Adding a new transaction or deal to OpenLaw finance is a snap. We provide generic tools to expand the types of deals involving digital assets.

Importantly, OpenLaw Finance also is not just about blockchains. All of the transactions on OpenLaw Finance are seamlessly tied to binding legal agreements and can be output as structured data (JSON objects), enabling issuers and other professionals to more readily build liquidity by providing the essential substrate to traders and other buy-side firms — data.

Example Transaction of OpenLaw Finance

By way of example, in the video below, we demonstrate how OpenLaw Finance can be used to create and issue tokenized stock on a vesting schedule. Using a simple form, you can create an ERC-20 token for any legal entity authorized by a binding legal document (a board authorization). Once signed by relevant parties, the tokens are automatically generated and placed into a smart contract-based escrow account, managed by the secretary of the company.

Tokenized stock can be transferred with a legally binding restricted stock grant to any recipient on a vesting schedule — all managed via a smart contract. The smart contract automatically releases the stock from escrow to the recipient on a pre-programmed schedule.

OpenLaw Finance – Open Investment Banking from Priyanka Desai on Vimeo.

Once the tokens are transferred the entire cap table related to the transfer of tokenized stock is managed via a blockchain and can be viewed in real-time on OpenLaw Finance. We create a dynamic list (and associated pie chart) showing each transfer and the amount of stock that has been fully vested.

Once generated, any tokenized stock can be automatically listed on a 0x exchange, enabling the token to be instantaneously traded. Parties can submit orders to buy or sell the underlying token. Token marketplaces can be created with a click.

OpenLaw Finance is Flexible and Customizable

The above is just one example of the types of transactions that can be built and orchestrated via OpenLaw Finance. The platform can be customized and is designed to be composable and flexible, providing the tools for anyone to create and manage transactions involving digital assets.

With OpenLaw Finance, you also can plug-in a variety of exchange software, identity services, hardware/software wallets, and even different oracle providers (like Chainlink) to build a variety of financial products.

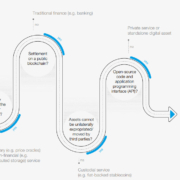

Below is a rough overview of how the various pieces of OpenLaw fit together.

OpenLaw Finance Infrastructure

OpenLaw Finance Going Forward

The release of OpenLaw Finance is just the beginning. Over the next several months, we’re going to incorporate Ernst & Young’s Nightfall, enabling private token transactions using zero-knowledge proofs. With this integration, every transaction on OpenLaw Finance will be private and managed in a peer-to-peer manner between parties all on mainnet Ethereum. We will also integrate one or more custodial solutions, such as BitGo or Trustology, and begin to partner with various different blockchain projects to create tools for their members (stay tuned).

Token generation, legal processes, and managing commercial workflows are foundational to the success of the burgeoning token economy. OpenLaw’s ease and flexibility in integration can connect other critical components such as identity, custody wallets, exchanges, and oracles, makes OpenLaw a conduit to connect various DeFi projects and assist with the commercial processes, getting us closer in fully realizing what open, transparent financial system can look like.

About OpenLaw

OpenLaw is a blockchain-based protocol for the creation and execution of commercial systems. Using OpenLaw, financial institutions and startups can more efficiently engage in the end-to-end commercial process in a highly secure and efficient manner, all while leveraging next-generation blockchain-based smart contracts.

To learn more about OpenLaw, check out our site and documentation for an overview and detailed reference guides. You can also find us at /"> or tune in in our community Slack channel. Follow our Medium and Twitter for further announcements, tutorials, and helpful tips over the upcoming weeks and months.

Hinterlasse einen Kommentar

An der Diskussion beteiligen?Hinterlasse uns deinen Kommentar!