Blame Mexican drug dealers when you have to report your crypto trades to regulators.

Expert Blog is Cointelegraph’s new series of articles by crypto industry leaders. It covers everything from Blockchain technology and cryptocurrencies to ICO regulation and investment analysis. If you want to become our guest author and get published on Cointelegraph, please send us an email at .

Larry Fink, CEO of the world’s largest asset management company, BlackRock, told a panel at the Institute of International Finance:

„Bitcoin just shows you how much demand for money laundering there is in the world. It’s an index of money laundering.“

Fink’s sentiment about virtual currencies reflected that of an IRS Criminal Investigation division official who told reporters in 2013 – after concluding a multi-jurisdictional investigation and shuttering a $6 billion virtual currency exchange for money laundering:

“If Al Capone were alive today, this is how he would be hiding his money.”

Drugs and money laundering

Recently, the U.S. Drug Enforcement Administration (DEA) published a report that provides an overview of the US efforts to police the global illicit drug trade. The report claims that virtual currencies – Bitcoin, Zcash, Monero, and Ethereum – are increasingly being used in the digital underground to facilitate trade-based money laundering schemes for transnational criminal organizations (TCO).

Over the past 10 years, the drug landscape in the US has vastly changed, with the opioid threat reaching epidemic levels in a significant portion of the country. Drug poisoning is a the leading cause of deaths in the US, with approximately 170 people dying from it every day. The opioid epidemic was declared a national emergency by President Trump last August, when Bitcoin was trading at $4,000.

Mexican TCOs and El Chapo

According to DEA’s report, the Mexican TCOs are the greatest criminal drug threat to the US. In the beginning of this year, when Bitcoin was trading at $1,000, the Sinaloa Cartel kingpin Joaquin Archivaldo Guzman Loera (El Chapo) was extradited by Mexico to the US. The extradition followed Mexico’s recapturing of the fugitive drug lord following his brazen escape from a maximum-security Mexican prison via an elaborate mile-long tunnel that connected to his prison cell.

In the US, El Chapo is facing a long list of criminal charges, including drug trafficking and money laundering, for running one of the most powerful and sophisticated transnational drug trafficking organizations in this world.

DEA’s report ties the extreme success of the Mexican TCOs to multiple factors, such as:

- By controlling lucrative southwestern drug smuggling corridors, Mexican TCOs export and transport significant quantities of illegal drugs into the US. El Chapo, in an interview with Rolling Stone magazine, boasted that he could “supply more heroin, methamphetamine, cocaine and marijuana than anybody else in the world.” He proudly took credit for overseeing up to half of the illegal drugs coming into the US from Mexico.

- To accomplish this, El Chapo said he had “a fleet of submarines, airplanes, trucks and boats.“ Last year, Mexican law enforcement officials confiscated the Sinaloa Cartel’s 599 aircrafts—a fleet larger than Aero Mexico’s. Some of these airplanes were outfitted with the latest intelligence, surveillance and reconnaissance (ISR) technologies to go undetected by the US border patrol.

- After selling the illegal drugs in the US – which brought in $64 billion each year – the Mexican TCOs needed a way to get the drug money back to Mexico. It became increasingly difficult for Mexican TCOs to deposit their illicit cash proceeds directly into US banks and other financial institutions once the worlds largest banks – HSBC, Wachovia and Citigroup – were hit with billions of dollars in penalties for laundering Mexican cartel money. Mexican TCOs were forced to resort to more complex multi-jurisdictional trade-based money laundering (TBML) schemes that included using cryptocurrencies.

Money laundering using cryptocurrencies

The DEA report pointed out that China has become an important hub for money laundering schemes. TCOs purchase large shipments of “made in China” goods using Bitcoin. These “made in China” goods are then shipped to businessmen in Mexico and South America who reimburse the TCOs in local currency. Bitcoin payments are widely popular in China because it can be used to anonymously transfer value overseas, circumventing China’s capital controls.

US proposes cryptocurrencies amendment to AML laws

On November 28, 2017, when Bitcoin was trading at $9,880, the US Committee on the Judiciary held a hearing on Senate bill S. 1241, titled ‘‘Combating Money Laundering, Terrorist Financing and Counterfeiting Act of 2017.” This bill amends the current US anti-money laundering laws (AML) by making virtual currencies more of a target for regulatory oversight. Prepaid access devices, digital wallets and other digital currency exchangers as being subjected to reporting requirements if they contain the virtual currency equivalent of $10,000 or higher.

According to Judiciary Committee Chairman Sen. Chuck Grassley, S. 1241 is designed to help modernize US AML laws. Grassley explained:

“[S. 1241 will give] law enforcement more tools to prosecute and close legal loopholes. It will clarify rules on evidence for prosecutors and judges, which in turn will help increase convictions. It will make it easier to go after drug kingpins, drug cartels and terrorist organizations by being able to seize virtual currencies more easily.”

EU amends AML transparency laws for cryptotrading

European governments are pushing for global Bitcoin regulation at the G20 level, coordinated by the Organization for Economic Co-operation and Development (OECD). Amid mounting alarm that virtual currencies are being used by multinational money-launderers, drug traffickers and terrorists, the German Finance Ministry explained:

“It makes sense to discuss the speculative risks of virtual currencies and their impact on the financial system at international level.”

Several EU countries will create interconnected registries this year, to record details of the beneficial ownership of inter alia companies and trusts under the EU Fourth Anti- Money Laundering Directive (4AMLD). These central registries of beneficial owners will be made available to local tax authorities and will be shared between tax authorities within the EU (OECD-BEPS Action 12).

On December 20, 2017, when Bitcoin was trading at $17,000, the European Parliament and its executive arm, the European Council, agreed to amend the 4AMLD. This amendment will make virtual currency exchange platforms and wallets subject to the beneficial ownership-reporting requirements (4AMLD Virtual Currency Amendment).

These new regulations will require an increase in transparency by trusts and trading companies, which will be pressured to reveal the holders of virtual currency in order to thwart potential money laundering, tax evasion and terror funding. Primary among these regulations is a requirement to provide beneficial ownership information to authorities and “any persons that can demonstrate a legitimate interest” to access data on the beneficial owners of trusts.

The 4AMLD Virtual Currency Amendment must be formally adopted by EU Member States and turned into national laws within 18 months.

Source: EU Amends AML Laws for Cryptotrading as US Ponders: Ex… | News | Cointelegraph

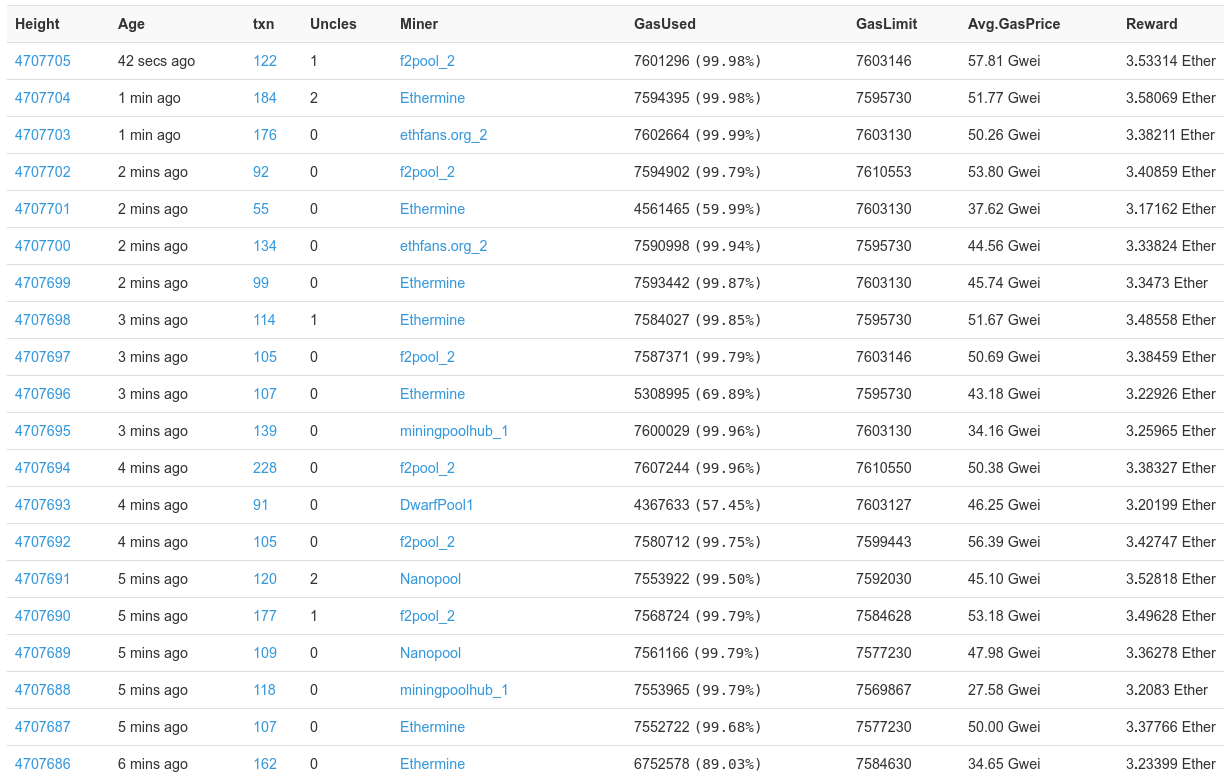

As can be seen above, blocks are still full because thousands of transactions are waiting to move, but the queue has been dropping from 25,000 to 20,000.

As can be seen above, blocks are still full because thousands of transactions are waiting to move, but the queue has been dropping from 25,000 to 20,000.